Nielsen’s COVID-19 Consumer Sentiment and Spending Intention Study

Understanding consumer sentiment in light of the COVID-19 crisis

Nielsen fielded a survey among 1000 adults, which launched on April 30th and closed on May 2nd in order to understand consumer sentiment in light of the COVID-19 crisis that has some interesting insights for the OOH industry.

Nielsen found that consumers’ attitudes fit into three buckets:

Those among the “Ready to Go” group are more likely to be younger, affluent, and with young children in the home. And they are 30% more likely than the total population to have been in a vehicle in the last day:

9 out of 10 of those in the “Ready to Go” group are very optimistic, expecting life to return to normal within a short window of time:

The “Ready to Go” segment is also ready to spend, overindexing the total population in plans to spend in the following categories following COVID-19 restrictions:

- Travel (Index 167)

- Household services (Index 147)

- Home improvement (Index 143)

- Auto parts/repair (Index 129)

- Food and dining (Index 113)

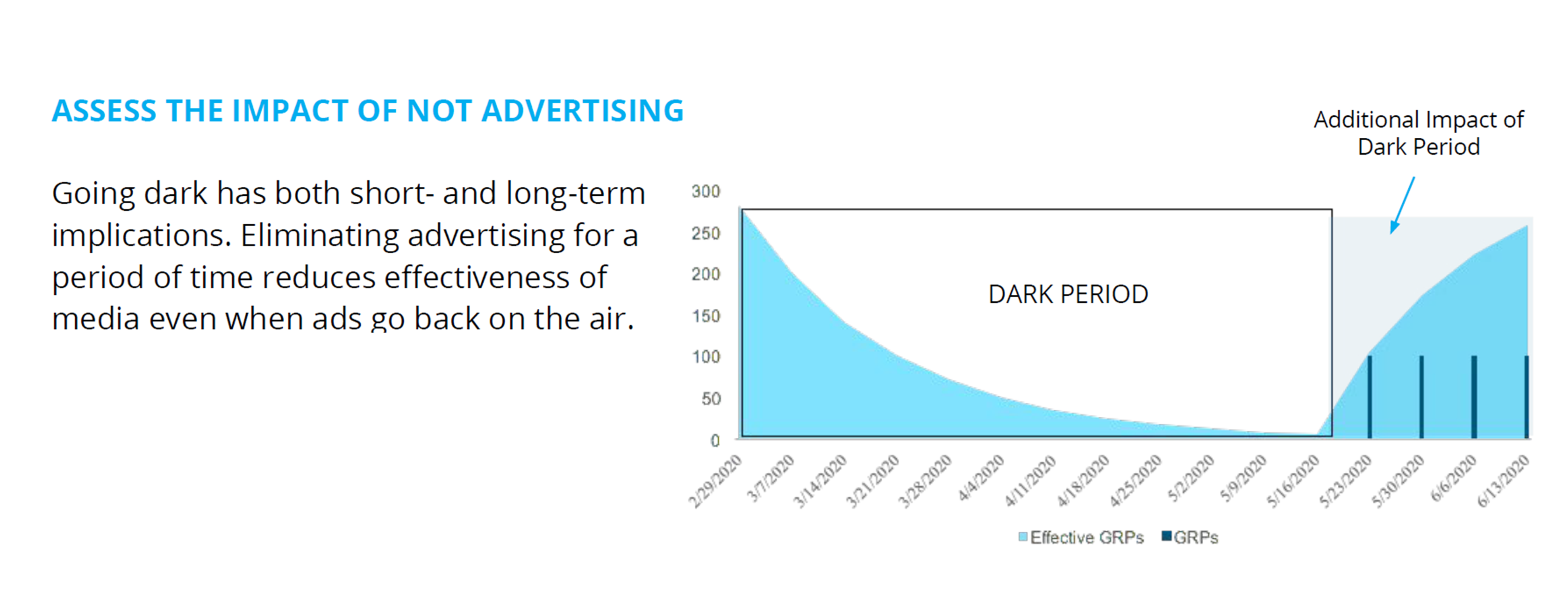

As consumers get behind the wheel again and get ready to spend, it is important that advertisers remain top of mind. In another study, Nielsen found that going dark on advertising has long-term negative implications:

“Nielsen’s Marketing Mix analyses show that short-term decisions to go dark also put long-term

revenue at significant risk—both incremental revenue and base sales, which are associated with

things like brand equity, distribution and product value. Nielsen’s database of long-term effect

models suggests that cutting advertising for the rest of 2020 could lead to an 11% revenue

decrease in 2021.”